Look at the ebbs and flows of your business — including your fiscal calendar, your staff schedules and your project cycles. Winter might be a less hectic time for a seasonal contractor, while a firm in the south might have projects year-round. The trade-off is that you’ll need other software to support other business areas, like estimating and takeoff. That said, you might not have the same estimating requirements as a residential contractor, GC, specialty trade contractor, etc. So best-of-breed systems with good third-party integration give you the opportunity to select other best-of-breeds that truly fit your company — or to stay with the systems you love. G/L reports by job, from income statements to cash flow analysis, automatically generated from your system without spreadsheets or extra work from you.

- That said, holidays and year-end close can often tie up key staff ahead of a January 1 transition.

- The FOUNDATION Construction Payroll Software Module helps contractors pay their crews on time — even with multiple prevailing wage, union, fringe, and tax rates on each construction project.

- Get scalable job cost reporting, automatic certified payroll, specialized billing, document management and more construction-specific features with one best-of-breed system.

- A vendor who stays active in developing their best-of-breed product is able to focus on addressing the latest needs in construction accounting because it’s their only priority.

Outsourced Construction Accounting Services

Our extensive range of offerings is designed to ensure that your financial records are in impeccable order, allowing you to focus on what matters most – growing your business. Our team of experienced professionals is well-versed in the nuances of South Dakota’s business landscape, ensuring that we can provide you with personalized solutions. Whether you are a small start-up or a well-established enterprise, we have the expertise to cater to your unique needs. In the dynamic landscape of contemporary business, the significance of proficient bookkeeping cannot be overstated.

- This Allows Us To Improve – The entire contractor bookkeeping services system by working on one process or job description and function at a time without disrupting the entire contractor bookkeeping system.

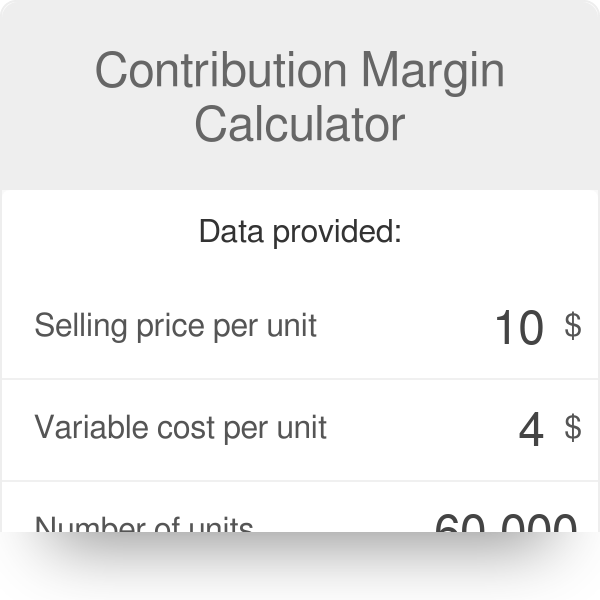

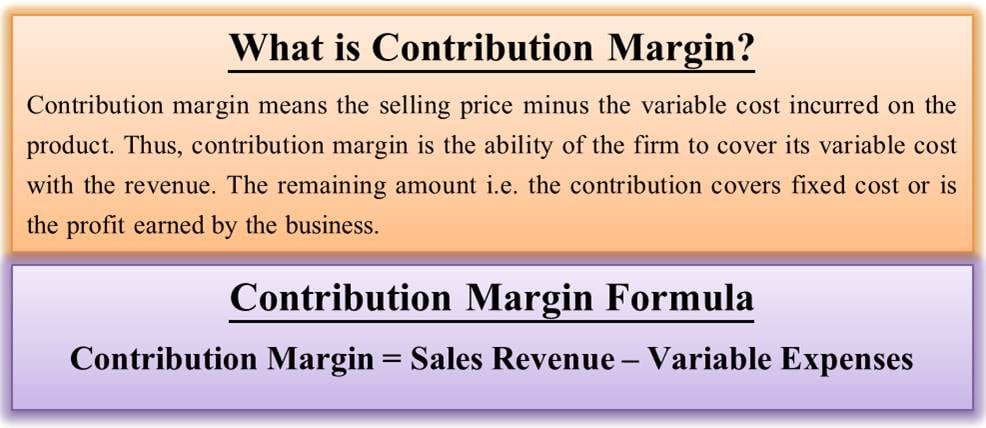

- Reporting includes information on revenue, expenses, debt, and profitability.

- Cost is affected by additional modules like equipment management, inventory and document imaging, as well as project management features.

- Trust us to streamline your financial management, enhance transparency, and maintain a clear financial picture for your business.

- There’s construction software that tracks financials, and then there’s construction accounting software.

Small businesses

You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials. Your bookkeeping team consists of 3 professionally trained bookkeepers, including one senior bookkeeper who reviews all of your monthly statements and your Year End Financial package. Join over 35,000 US-based business owners who have streamlined their finances and have grown their businesses with Bench. Say goodbye to piles of paperwork and time-consuming manual tracking—we automate inputs directly from linked accounts. Get insights from one central dashboard so you can easily understand the health of your business and make strategic decisions. To contribute to the construction bookkeeping overall financial health of your business, you need to understand asset management and the concepts of capitalizing and depreciat…

FREQUENTLY ASKED QUESTIONS

Sen. Mike Rounds, R-South Dakota, called out pay raises for service members in a news release sent over the summer, when the Senate Armed Services Committee passed the bill. Rounds, a member of the committee, also supported the bill in the full Senate on Wednesday. In a news release on the legislation, South Dakota Republican John Thune praised the vote as a win for the state.

You can build job budgets with your company’s job cost structure and compare project performance against estimated revenue, costs, labor hours, and quantities. In addition to open and honest communication, I will https://azbigmedia.com/real-estate/commercial-real-estate/construction/how-to-leverage-construction-bookkeeping-to-streamline-financial-control/ scale my solutions to fit your business and budget. Small business owners don’t need the same services as a large corporation, and individualized quotes allow you to only pay for what you need. And since I live and work in the USA, I am available for questions during normal business hours.