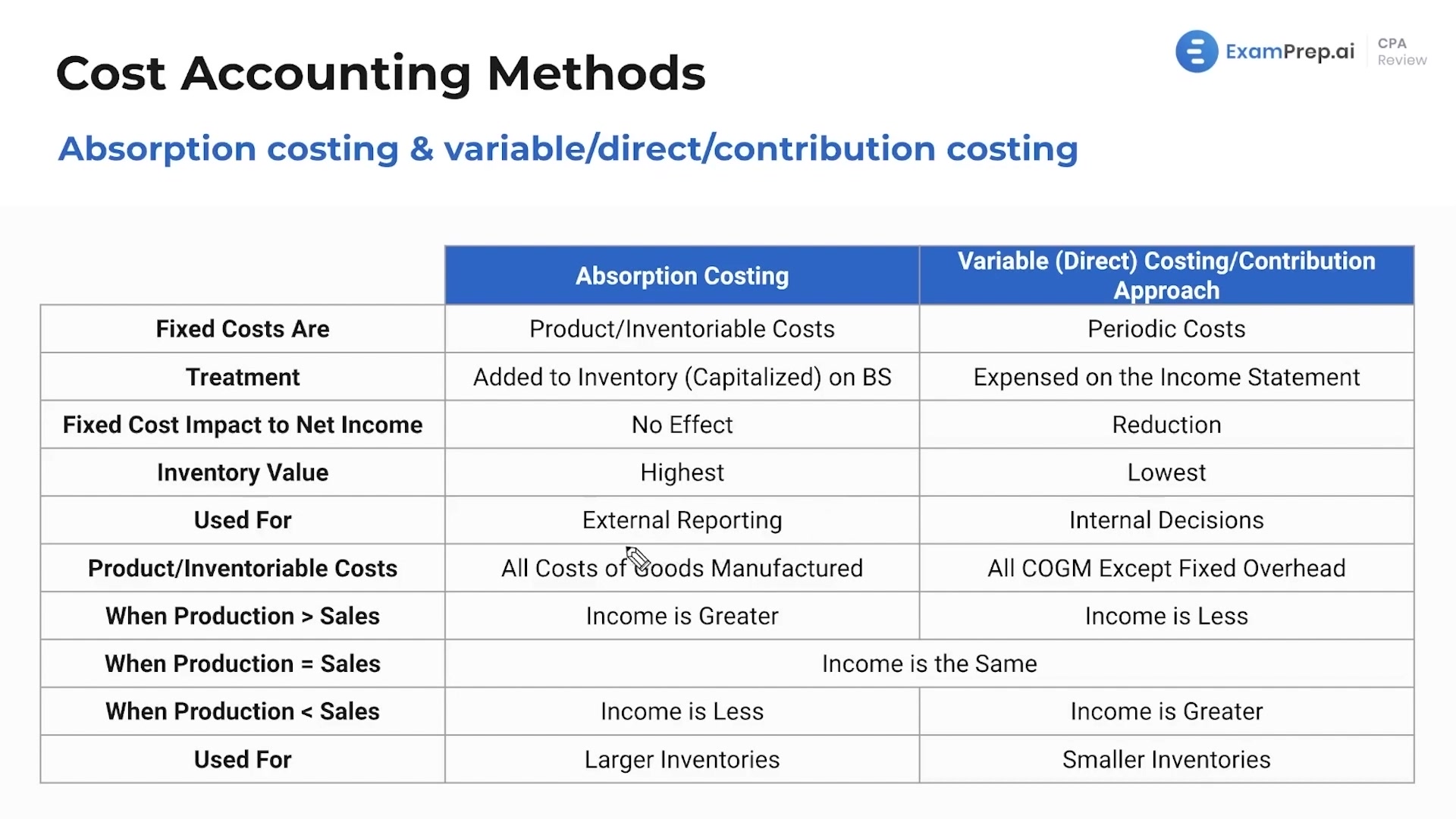

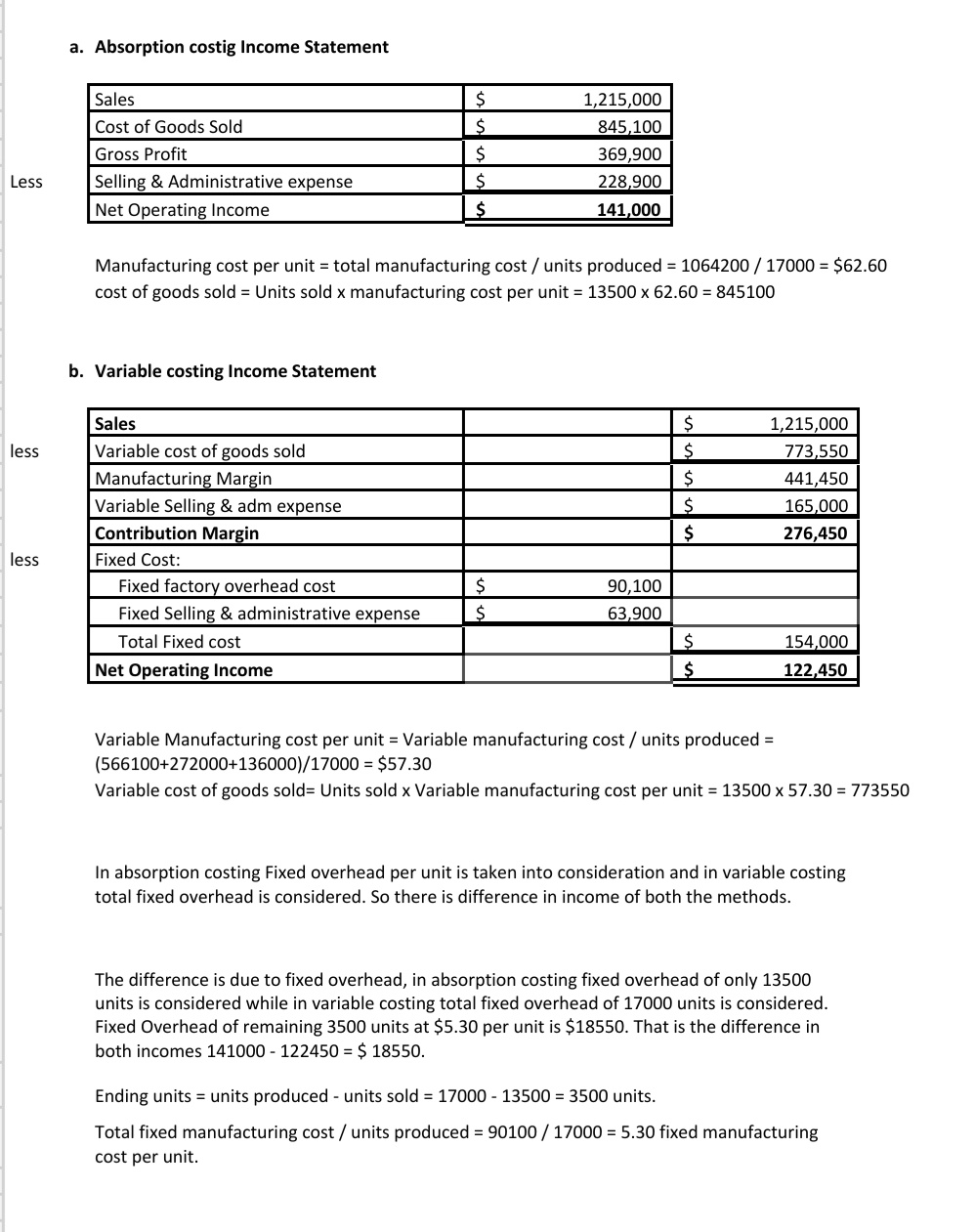

We will use the UNITS SOLDon the income statement (and not units produced) to determinesales, cost of goods sold and any other variable period costs. Next, we can use the product cost per unit to create the absorption income statement. We will use the UNITS SOLD on the income statement (and not units produced) to determine sales, cost of goods sold and any other variable period costs. In summary, absorption costing provides a full assessment of production costs for inventory valuation, while variable costing aims to show contribution margin and provide internal reporting. Most companies use absorption costing for external financial reporting purposes. The absorption costing formula provides a reliable approach to allocate both variable and fixed manufacturing costs to units produced, yielding precise per unit costs.

What’s the Difference Between Variable Costing and Absorption Costing?

- The products that consume the same labor/machine hour will have the same cost of overhead.

- The method includes direct costs and indirect costs and is helpful in determining the cost to produce one unit of goods.

- We will use overhead absorption costing, which is absorption by labor hour.

- Consequently, net income tends to be higher under variable costing when production exceeds sales, and lower when sales exceed production.

- Since 2014, she has helped over one million students succeed in their accounting classes.

Variable costing only includes the product costs that vary with output, which typically include direct material, direct labor, and variable manufacturing overhead. Fixed manufacturing overhead is still expensed on the income statement, but it is treated as a period cost charged against revenue for each period. It does not include a portion of fixed overhead costs that remains in inventory and is not expensed, as in absorption costing. Finally, remember that the difference between theabsorption costing and variable costing methods is solely in thetreatment of fixed manufacturing overhead costs and incomestatement presentation. Regarding selling andadministrative expenses, the only difference is their placement onthe income statement and the segregation of variable and fixedselling and administrative expenses.

Absorption Costing Profit Formula: Understanding COGS

This means the cost of ending inventory on the balance sheet is higher compared to variable costing methods. So in summary, absorption costing income statements allocate all manufacturing costs (variable and fixed) to inventory produced. This results in fixed costs impacting COGS rather than flowing straight to the income statement. Under the absorption costing method, all costs of production, whether fixed or variable, are considered product costs. This means that absorption costing allocates a portion of fixed manufacturing overhead to each product. Under generally accepted accounting principles (GAAP), absorption costing is required for external reporting.

Accounting Jobs of the Future: How Staffing Agencies Can Help Land Them

See the Strategic CFO forum on Absorption Cost Accounting that helps managers understand its uses to learn more. In periods where production declines, the opposite effect happens – fixed costs are released from inventory, increasing cost of goods sold and lowering net income. Absorption costing states that every product has a set overhead cost, regardless of whether it is sold or not during a certain period. This means that all costs must be included at the end of an inventory, which is normally done as a balance sheet asset.

How Is Absorption Costing Treated Under GAAP?

The Big Three auto companies made decisions based on absorption costing, and the result was the manufacturing of more vehicles than the market demanded. With absorption costing, the fixed overhead costs, such as marketing, were allocated to inventory, and the larger the inventory, the lower was the unit cost of that overhead. For example, if a fixed cost of \(\$1,000\) is allocated to \(500\) units, the cost is \(\$2\) per unit. While this was not the only reason for manufacturing too many cars, it kept the period costs hidden among the manufacturing costs. Using variable costing would have kept the costs separate and led to different decisions. Under absorption costing, all manufacturing costs, both direct and indirect, are included in the cost of a product.

Therefore, fixed overhead will be allocated by $ 1.50 per working hour ($ 670,000/(300,000h+150,000h)). This means the company would allocate $10 of overhead to each unit produced. But the actual number of manufactured units is 170,000, so we simply have to multiply the manufactured units by $8 to get $1360,000 as the cost of manufactured goods. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. Production is estimated to hold steady at \(5,000\) units per year, while sales estimates are projected to be \(5,000\) units in year \(1\); \(4,000\) units in year \(2\); and \(6,000\) in year \(3\).

External reports are generated for public consumption; in the case of publicly traded corporations, shareholders interact with external reports. External reports are designed to reveal financial health and attract capital. All fixed costs, including manufacturing overhead are reported on the income statement at the given amount. In summary, absorption costing provides a comprehensive view of production costs for improved decision-making, even though net income may fluctuate more between periods. Mastering these mechanics can lead to GAAP-aligned and incremental accounting.

After that, we get the Cost of Goods Sold by adding administration expenses. Lastly, we find out the Total Cost by adding selling and distribution expenses. After that, it imposes all these costs on Operations or Production during profit estimation. Consequently, Absorption Costing is alternatively called Total Cost Method and Full Costing. Since this method is widely used by many manufacturing companies, it is necessary yo know the advantages and disadvantages of the same. This means that we now need to remove the effect of over-absorbing $40000, which can be done simply by subtracting it from the cost of sales.

Unethical business managers can game the costing system by unfairly or unscrupulously influencing the outcome of the costing system’s reports. However, the managers prefer marginal costing over absorption costing for managerial decision-making. Companies can use absorption, variable, cash flow statement indirect method or throughput costing for internal reports. The U.S. Securities and Exchange Commission (SEC) and GAAP are primarily concerned with external reporting. Since this method shows lower product costs than the pricing offered in the contract, the order should be accepted.