This means that inventory is valued to include both direct costs of materials and labor as well as a portion of fixed manufacturing overhead costs. In order to understand how to prepare income statements using both methods, consider a scenario in which a company has no ending inventory in the first year but does have ending inventory in the second year. Outdoor Nation, a manufacturer of residential, tabletop propane heaters, wants to determine whether absorption costing or variable costing is better for internal decision-making. It manufactures \(5,000\) units annually and sells them for \(\$15\) per unit. The total of direct material, direct labor, and variable overhead is \(\$5\) per unit with an additional \(\$1\) in variable sales cost paid when the units are sold. Additionally, fixed overhead is \(\$15,000\) per year, and fixed sales and administrative expenses are \($21,000\) per year.

Types of Companies in Managerial Accounting

Kristin is a Certified Public Accountant with 15 years of experience working with small business owners in all aspects of business building. In 2006, she obtained her MS in Accounting and Taxation and was diagnosed with Hodgkin’s Lymphoma two months later. Instead of focusing on the fear and anger, she started her accounting and consulting firm. In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life. Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses.

Income Statements for Merchandising Companies and Cost of Goods Sold

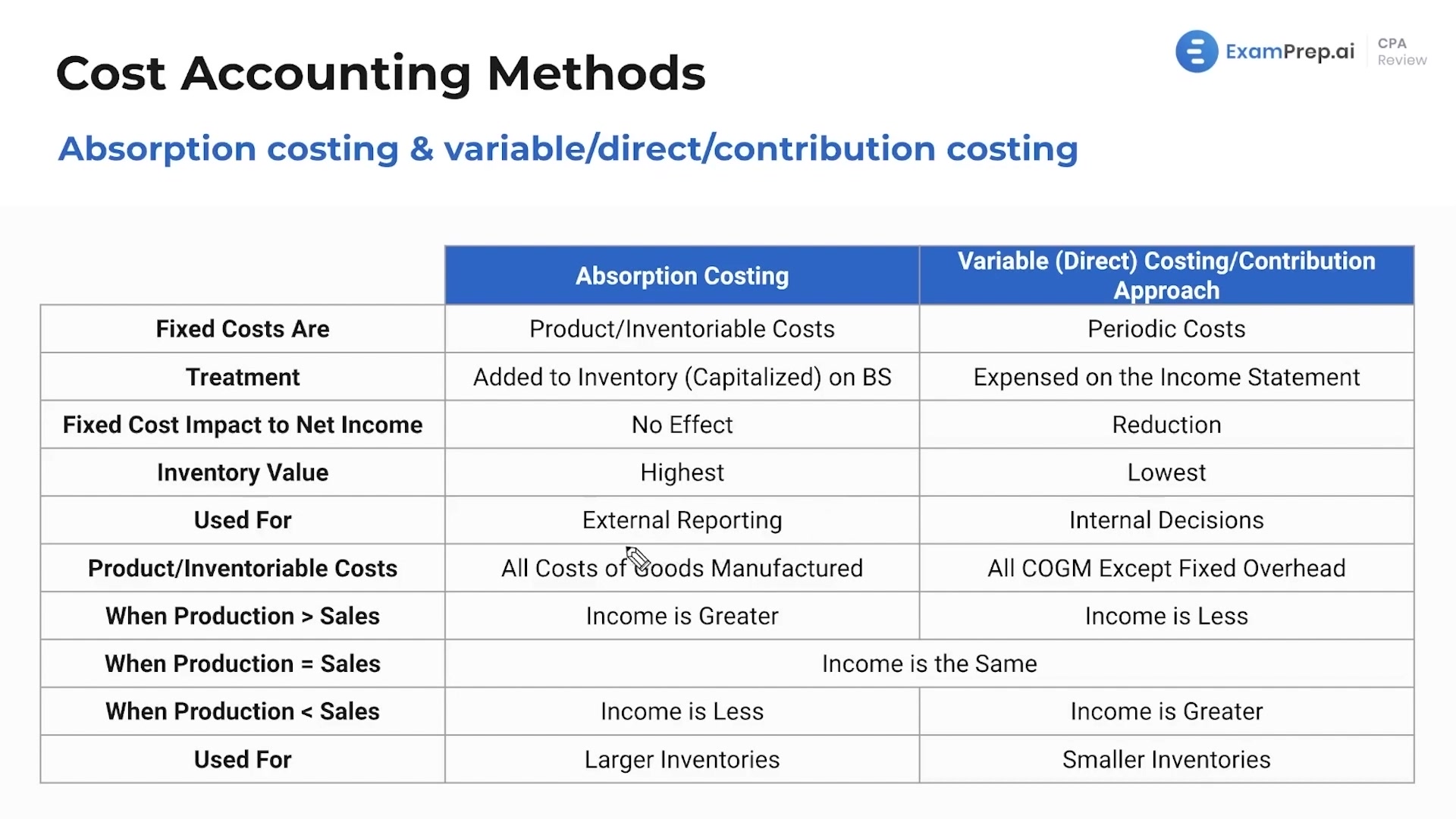

Fixed overhead is not always included in the value inventory of variable costing. It is necessary to note that there would always be an imbalance in the balance sheet of absorption cost; the inventory is always higher than the expenses on an income statement. This is because an absorption cost includes manufacturing products, employees’ wages, raw materials, and every other production cost. Income increases as production increases and decreases as production decreases. Fixed manufacturing overhead costs go to the balance sheet when incurred and are not expensed until sold.

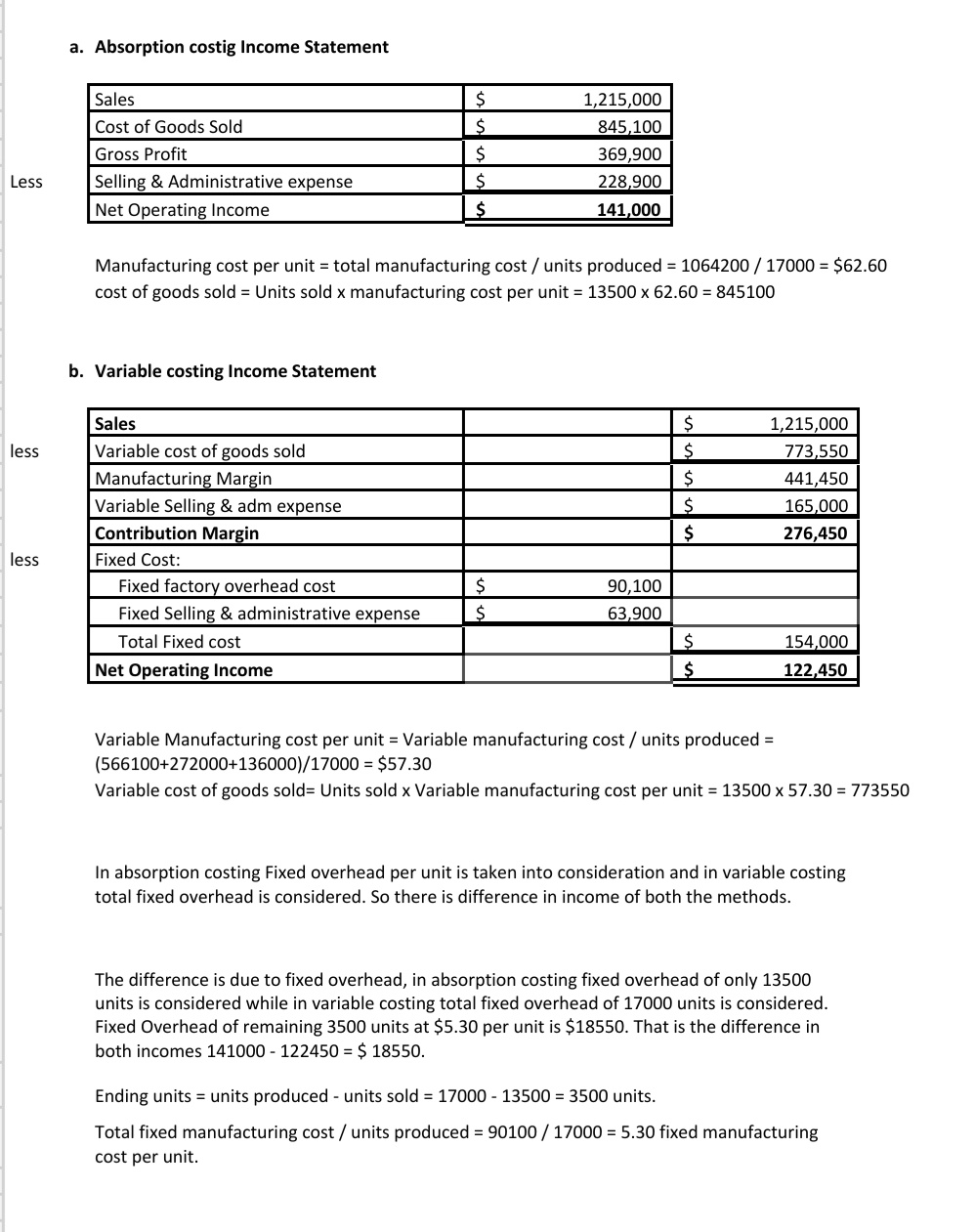

Determining Unit Product Cost: Absorption Costing Approach

These extra units include the element of fixed cost because our absorption rate has both variable and fixed costs in it. Once you have the cost per unit, the rest of the statement is fairly easy to complete. This includes sales, cost of goods sold, and the variable piece of selling and administrative expenses.

Absorption Costing And Variable Costing.

Under full absorption costing, variable overhead and fixed overhead are included, meaning it allocates fixed overhead costs to each unit of a good produced in the period–whether the product was sold or not. The treatment of fixed overhead costs is different than variable costing, which does not include manufacturing overhead in the cost of each unit produced. Absorption costing allocates all manufacturing costs, including fixed overhead costs, to the units produced. This differs from variable costing, which only allocates variable costs. Here are two examples showing how absorption costing is applied in practice. Absorption costing is a GAAP-compliant method of accounting for all manufacturing costs as product costs, including both variable costs and fixed overhead costs.

Pros of variable costing:

- Under generally accepted accounting principles (GAAP), absorption costing is required for external reporting.

- These variablemanufacturing costs are usually made up of direct materials,variable manufacturing overhead, and direct labor.

- However, absorption costing depends heavily on cost estimates and output assumptions.

Absorption costing is a very widely used costing system and public entities are bound by GAAP to use absorption costing when reporting their earnings to shareholders. The different methods of costing used in a manufacturing business, result in variations in the format of income statements. The traditional income statement, also called absorption costing income statement, uses absorption costing to create the income statement.

Use a different format for each (see above), however, all amounts will be the same on both statements with the exception of fixed manufacturing overhead. In summary, the overhead absorption rate tax deductions for owner helps allocate a fair share of indirect overheads to each product based on expected production volume. Overall, this statement is much easier to make if you understand product and period costs.

The main advantage of absorption costing is that it complies with generally accepted accounting principles (GAAP), which are required by the Internal Revenue Service (IRS). Furthermore, it takes into account all of the costs of production (including fixed costs), not just the direct costs, and more accurately tracks profit during an accounting period. The variable cost per unit is \(\$22\) (the total of direct material, direct labor, and variable overhead).